Personal finance is the ability to manage your money, investment, and savings. The term circumscribes mortgages, insurance, retirement plan, investment real estate, and taxes. Financial freedom is brought by personal profit. You need a mission statement for personal finance to succeeds with your money.

If you want to build wealth and get out of debt, you need to have a mastery of money. Maths and psychology is needed for you to succeed in this. Wealth accumulation is achieved through personal profit.

The lie in personal finance

The biggest lie in financial freedom is spending less to be rich. Individuals in the poverty line in America should consider increasing their income and not reducing their expenses. High-income earners should consider cutting costs and put their focus on personal profits.

Frugality is another aspect of personal finance that can lead to saving but not make you rich. This school of thought shows cutting costs on small things such as what you eat and drink. The only problems come in on how many times you save on an item. Saving for at least a year can enhance your personal profit.

Big wins accumulate wealth

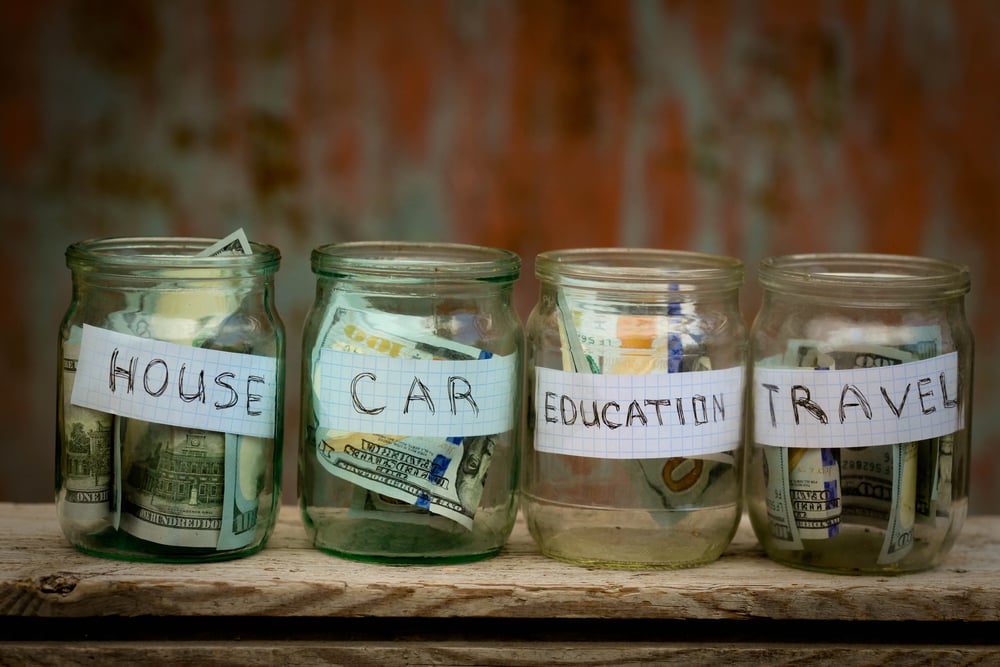

The truth is that big wins lead to quick wealth accumulation. Cutting costs on big things such as housing and motor vehicle can give you financial freedom. Salary negotiation can also improve your wealth. Reduction of significant expenses by at least 1% can be a great accomplishment. To become financially independent, you don’t need to have a high income. It is the diligence you put on cutting costs with your average salary. Purchasing items based on personal needs and not wants reduce spending habits.

Apart from cutting costs, it’s also important to consider how you can increase your income. You will be able to meet your objectives when your income is boosted comfortably. Some of the ways to increase your money include the following.

1. Be informed and educated

Education is an essential aspect of your life. You can control your studies compared to other factors of life, such as age and race. The more educated you are, the better your chances of earning more.

2. Be a good employee

Becoming a productive employee in your workplace brings you great rewards. Avoid complaining and taking unnecessary offs. Embracing work ethic is not only fulfilling but shows your boss you are ready for more.

3. Salary negotiation

If you know your worth in an organization, then you will negotiate your salary. Many people are afraid to face their employer and negotiate their salaries and end up losing much. Some employers need you to approach them for a raise, while others do it after seeing your hard work and determination in the workplace.

4. Get extra income

There are various jobs you can do besides your career for extra income. investment does not require you to be actively involved since an intermediary is involved in helping you get the best out of your investment. You can also start a blog or sell stuff based on your passion.

The bottom line is for a person to get rich; they need to properly manage their lifestyle by cutting costs on the big stuff.