Retirement may seem like a million years but it will sneak up on you quickly. If you haven’t a plan in place now you need to start thinking about one (unless you are reading this article at 12 years old, in that case, relax). While you need a retirement plan that doesn’t mean you need to save all your money in your retirement fund. There are other ways to save and you should approach your retirement strategically, as with any other issue that needs to be solved.

Most retirement schemes have a maximum amount that you can contribute each year, while the temptation, and often the advice, is to max out that contribution, it is not always the best idea. While saving for your retirement is a good idea you should ensure you have enough money to achieve your goals in the short term too.

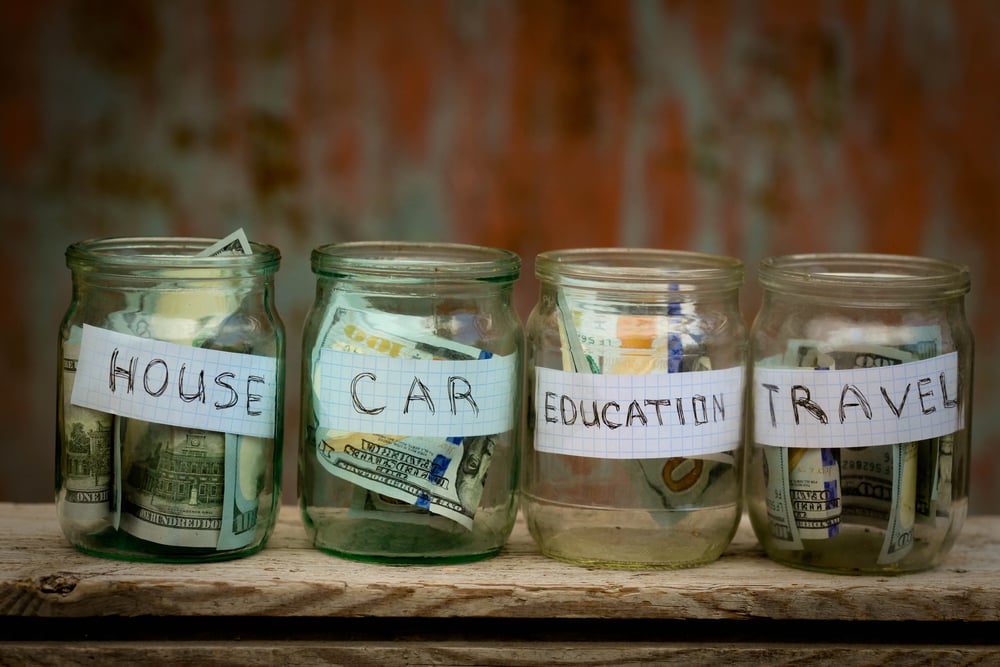

If you have a family than you will likely need to support their education so some of your savings must go towards a college fund. If you have high credit card debt it doesn’t make sense to let that grow while patting yourself on the back for growing your retirement fund. A simple principle is to realize that money is worth more today than it will be tomorrow. With this in mind always use money as if it is losing value. Find ways to make the most out of it before this happens. While you still need to save, you must save smart.

If your company matches some of your retirement contributions it is a good idea to max out the amount they will match. That is free money and you should never turn down free money.

If all of your finances are in a good place then you should still question whether all your additional money going into retirement is the right idea. Other investment options may return a higher amount. Do your homework and make the right choice for your money.